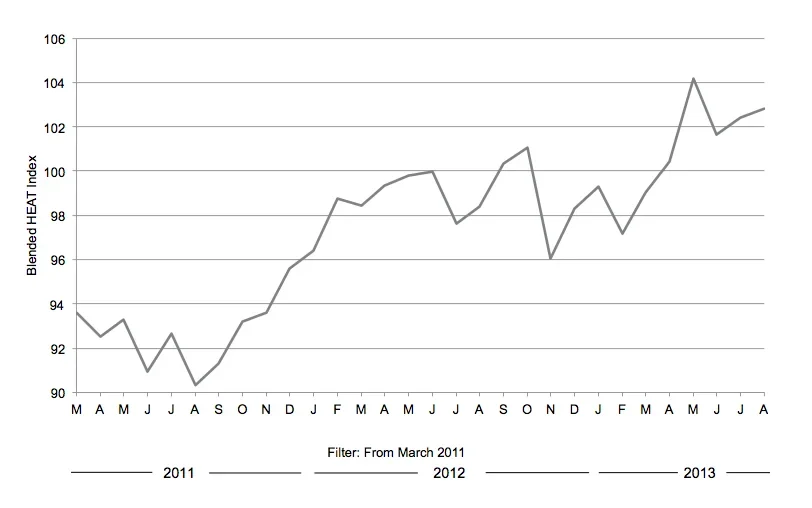

Increased optimism in household finances and business activity has generated a modest uptick in consumer confidence so far in August, the most recent data from the YouGov US Household Economic Activity tracker shows.

The Index – which tracks how secure Americans feel in their place of work, household finances and home ownership – increased 0.4 points in the second week of August to 103 from 102 in July. Analysis is based on data collected to August 14. The Index is slightly behind the nearly three year high of 104 in May 2013, when confidence in a housing market pickup drove scores to their highest level since tracking began.

HEAT Index (All Adults)

Finances in check

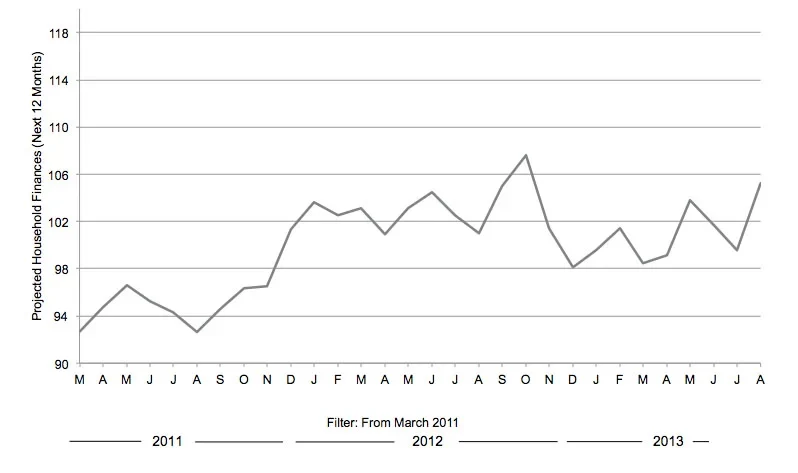

One in ten consumers (10%) think their household finances have improved in August so far, compared with 9% through the month of July. Whereas in July 23% of adults thought their household finances had got worse, this was the case among 22% in mid-August.

Americans are more positive about their future finances than in July. 28% of the population predicts their finances will be in better shape in a years’ time, and 49% predict no change. In July, 24% of consumers had predicted a better outlook in a year’s time and 51% predicted no change.

The proportion of adults posting a pessimistic prediction also improved from July, as 23% thought their household finances would get worse in 12 months compared with 25% in July.

Cash confidence among high earners remains in negative perception. In mid-August, 10% of adults earning more than $100,000 thought their household finances had got better over the previous month and 21% thought they were worse than the previous month – no change from July.

Projected household finances, next 12 months (All Adults)

July homeowner high drops

Homeowner confidence continued to grow through July amid movement in the US housing market, but this has dropped slightly in the mid-August figures.In July, 16% of homeowners reported they thought their house had risen in value in the past month, which has risen to 17% in mid-August. However, while in July just 18% observed a fall in their property value over the previous month, this reached 22% in mid-August.

Forward-looking confidence has improved in the past fortnight. As in July, 27% of homeowners said they expect their house to improve in value in the next 12 months. Now just 19% expect their property value to fall – down from 20% in July.

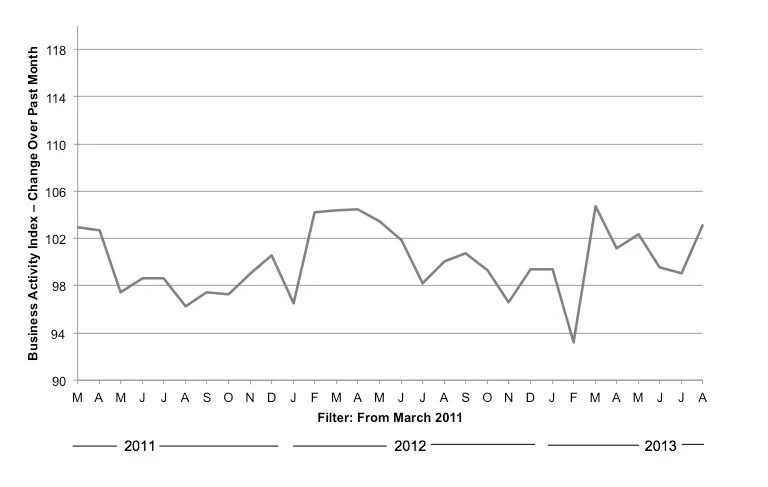

Business improvement drives scores

A perception that workplace business activity has improved since July has been keeping Index scores high. 19% of employed respondents thought that business activity had improved at their place of work, while 16% observed a decrease in activity. The mid-August update is an improvement on July, when 18% had observed an increase and 19% a decrease in activity.

The improved perception of activity took place after the US unemployment rate fell to its lowest level in more than four years in July, with the addition of 162,000 new jobs to the economy.

Business Activity: Change over last month (All Adults)

Mixed employment outlook

While higher earners are more confident in August, overall job security fears have made a comeback this month. Workers’ confidence in employment dropped slightly from July, particularly among younger respondents.

Whereas in July 12% of workers thought their job was more secure than last month, and 15% thought it less secure, in mid-August 11% thought their job was more secure and 16% thought it less secure.

The 12-month low in employee confidence of November 2012, when 21% of workers thought their jobs had got less secure.

The jobs outlook has seen deterioration since last month amid a slowing in the pace of hiring throughout July. 11% of workers think it is somewhat likely and 5% very likely they will lose their jobs in the next 12 months. In July, 9% had said it was somewhat likely and 5% saw it as very likely they would lose their position.

42% of workers feel it is very unlikely they will lose their jobs, down from 44% in July.

The jobs outlook for mid-August is more positive among workers earning $100,000 or more. 12% of higher earners thought their job had got more secure over the previous month, compared with 10% among those who responded in July.

The jobs outlook among higher earners has also improved from July, when forward looking job security hit an all time low. Whereas in July 44% thought it very unlikely they would lose their jobs, this reached 50% in mid-August to outstrip the national average.

But employed Americans aged between 18 and 34 feel their employment is less secure than the previous month. Whereas 23% of employees aged 18 to 34 felt their job was more secure than the previous month in July, this dropped to 17% in mid-August. Confidence they would hold onto their jobs also decreased. 41% of 18-34 year olds thought it was very unlikely they would lose their jobs in 12 months, compared with 44% among this age group in July.

Government confidence uptick

Despite job fears and tentative housing predictions, national confidence in the Government’s handling of the economy has improved. Amid the fall in unemployment, 9% of Americans think they are more confident in the Government and 41% are less confident. In July, 6% of Americans had said they were more confident than the previous month, and 45% were less confident.