After their Christmas 2013 data breach took them on one of the sharpest consumer perception drops since 2010’s BP oil crisis, Target is still considerably short of where it was before the crisis broke.

An even bigger breach victim from mid-September, Home Depot dropped down to its lowest consumer perception levels since the end of January 2009. Although the fall was not as steep as Target and they began rebounding much sooner, Home Depot is still significantly short of where it was in consumer perception before its breach.

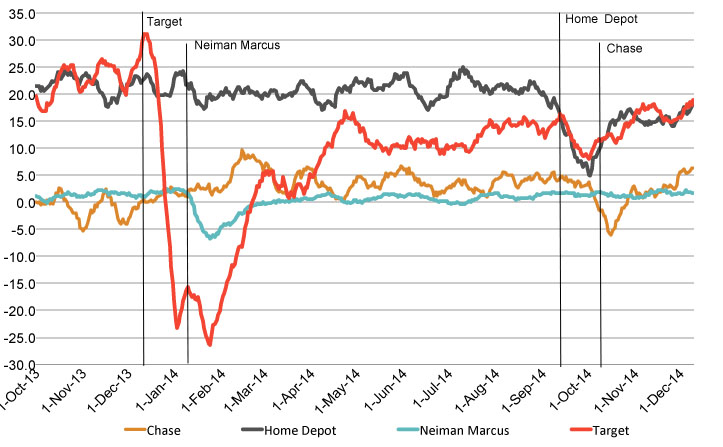

The bigger difference for Home Depot, however, is that purchase consideration levels for the brand have nearly recovered to pre-crisis levels, a predictor of future revenue opportunity. Target’s, on the other hand, are still depressed nearly one year since its breach.

Just before Target’s breach in late December, 50% of consumers said they would consider buying there the next time they were shopping. That dropped to 35% by early January, and is currently at 42%. By comparison, Home Depot dropped just seven percentage points, from 47% in mid-September to 40% two months later. They are now at 43%.

Compared to Target and Home Depot, the 2014 data breaches experienced by Neiman Marcus in January and JPMorgan Chase in September caused smaller consumer perception drops and faster bounce-backs to their previous levels.

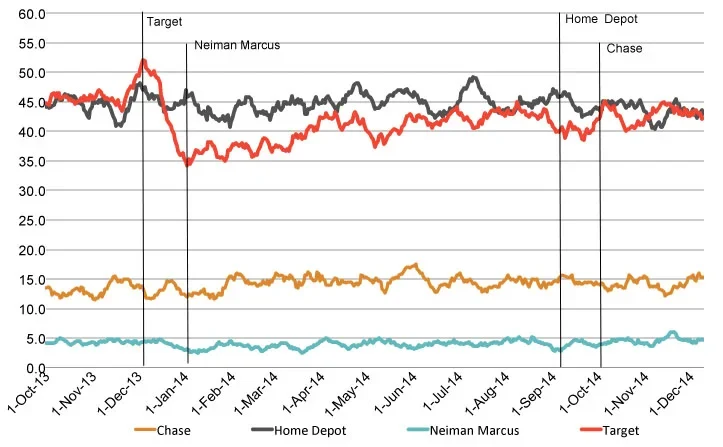

Other than the Purchase Consideration metric, JP Morgan Chase, Home Depot, Neiman Marcus and Target were measured with YouGov BrandIndex’s Buzz score, which asks respondents: "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?" All respondents are adults age 18 and over.

Buzz: Target, JPMorgan Chase, Neiman Marcus, Home Depot

Purchase Consideration: Target, JPMorgan Chase, Neiman Marcus, Home Depot